The Warwickshire Outlook: Brexit: Some smoke… but no fire

Our Economic Outlook in the July edition of Warwickshire Means Business was published very soon after the outcome of the referendum and looked at the potential implications for the economy as a result of this decision.

Almost three months later, it has become apparent that many of the dire warnings made before (and immediately following) the referendum have not come to pass. The economy has remained relatively stable and the immediate shock that was seen in various surveys of consumers and businesses has quickly rebounded.

Unemployment has not increased and, in fact, recent figures show a continued small decline in numbers of claimant numbers in Warwickshire. Economists are steadily revising their forecasts, pencilling in stronger than initially expected growth-rates for the remainder of this year (the Bank of England, the OECD, Morgan Stanley and others have all increased their forecasts for growth in the second half; and a survey of economists shows that the majority - two thirds - think a recession in 2016 is unlikely, compared to the opposite view two months ago).

So why the change in view? Well, firstly and most importantly, it has been recognised that, in real terms, nothing has actually changed. The UK remains part of the European free market for the time being, and any negotiated exit will undoubtedly take a long period of time and any impacts will happen later rather than sooner.

Secondly, the Bank of England has taken proactive measures to calm markets and keep things on an even keel. Interest rates were cut to 0.25% (which discourages saving and encourages spending, while also keeping the value of the pound low) and a programme of quantitative easing initiated.

Thirdly, the devaluation of pound has boosted exporting activity (which has benefited the manufacturing sector) and encouraged overseas spending in the economy.

This is not to say, however, that there are not continued risks and downward pressures on the economy. There are ongoing concerns about businesses holding back on investment decisions while uncertainty around Brexit continues and pessimism coming from business surveys about future orders and sales; the Bank of England has strongly hinted that a further cut in interest rates to 0.1% might be necessary (which increasingly is getting priced into market expectations – this effectively means that, if it doesn’t happen, there will be a negative reaction which the Bank will want to avoid thus making it highly likely). And, while exporting has been boosted through a low pound, our trade deficit (the difference between the value of goods and services imported and exported) remains stubbornly high.

Brexit is a theme which is clearly going to dominate discussions on the economy for many years to come. The recognition of the long-term nature of this process is to be welcomed, as it eases short-term, knee-jerk reactions and enables a considered and risk-based approach to be undertaken which should minimise potential negative impacts.

This also creates the opportunity to consider wider underlying structural issues and potential pinch-points within the economy and provides space to consider how they could be addressed through this process.

Migration and labour demand

One such issue that will need to be considered and addressed through the Brexit process is the supply of, and demand for, non-domestic workers to address gaps in the labour market.

While it is likely that any new immigration controls would still allow skilled people who are needed to fill identified skill shortages (nurses, doctors, computer programmers, etc.), filling low-skilled jobs (care workers, shop assistants, warehouse workers, catering and bar staff, agricultural workers, etc.) will be much harder. Furthermore, the impact on these controls may affect some areas more than others.

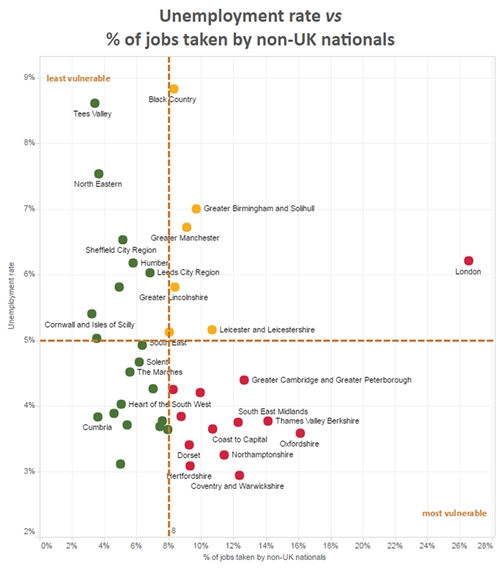

Regeneris Consulting have recently undertaken analysis of which Local Enterprise Partnership areas may be most vulnerable to immigration controls. They looked at two key factors – current levels of unemployment (to identify areas that have a tight labour market due to low levels of unemployment) and the proportion of jobs filled by non-UK nationals. The outcome of this research is presented below, and shows that the Coventry & Warwickshire LEP is one of the areas most vulnerable to controls on the labour market.

Further work is required locally to further unpick this issue (i.e. what sort of jobs in Coventry & Warwickshire are filled by non-UK nationals, what are the drivers behind this, etc.) and explore what can be done to help address and mitigate this potential risk.

The Skills for Employment programme, in which the council has invested significant resources, is potentially a key policy tool to help improve the development of locally suitable labour by improving connections between businesses and schools, colleges and universities, and identifying and tackling skills shortages in the local economy.

For further information on this programme, see: www.warwickshire.gov.uk/skillsforemployment

Source: Regeneris Consulting (http://regeneris.co.uk/latest/blog/entry/brexit-what-would-australian-style-immigration-controls-mean-for-local-labo)