The Chinese Crash & “global headwinds”

Monday 24th August has, almost inevitably, been dubbed by market analysts as “Black Monday” because of the huge one day falls in, at first, the Chinese stock market and then stock markets across the world, leading to $11 trillion being wiped off the value of shares world-wide (including £74bn off the FTSE 100). This one-off event is part of a substantial 40% fall in share values in China since June, highlighting the increasing weakness and fragility of the Chinese economy which has seen growth slow significantly and a surprise devaluation of the yuan. More widely across the global economy, there are concerns about the impacts of this slow-down, the lack of monetary policy levers that are left to be pulled by western economies, and the continued reliance of the markets on fiscal stimulus packages.

The Bank of England has highlighted the increasing “global headwinds” facing the UK economy as a result of what is happening in China, although it appears to still be pencilling in an interest rate rise early in 2016. However, recently published data on the UK economy are starting to suggest we are feeling the impact of these winds. Business confidence has fallen for the fifth month in a row, based on the optimism index compiled by accountants BDO. The manufacturing sector is particularly downbeat, recording its lowest levels of confidence since November 2012. This is mirrored by the manufacturing sector body EEF, who have halved their growth forecasts for the sector to 0.7% for 2015, down from 1.5%. EEF also reported that from their surveys of members, for the first time in more than two years, more companies were reporting a drop in output than a rise. Official data from the Office for National Statistics reported a 0.8% decline in manufacturing output in July, taking production to 0.5% below the level of a year ago. These reductions are largely due to a reduction in exports as the global economy, and the Chinese economy in particular, slows and an increasingly strong sterling makes UK goods relatively more expensive. Latest data on UK trade confirms this, with goods exports falling to their lowest level since 2010 and, although trade in services retains a healthy surplus, this is not enough to outweigh the weaknesses in goods, therefore increasing the trade gap between imports and exports to £3.4bn in July.

As a result of all this, many economists are now downgrading their growth forecasts for the UK for this year, and the likelihood of an interest rate rise at the beginning of 2016 more on the downside.

Coventry and Warwickshire Quarterly Economic Survey

The Coventry and Warwickshire Chamber of Commerce, in conjunction with all Chambers across the country, undertake a Quarterly Economic Survey of businesses to monitor business performance and confidence. The national returns are used by the Bank of England to help shape and inform their policy decisions. This year, Warwickshire County Council and Coventry City Council are providing support to the Chamber to help boost the sample size to make it more representative and statistically accurate.

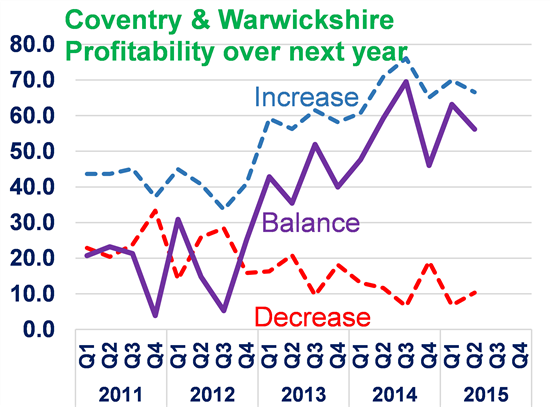

The latest findings (Quarter 2) show that the businesses of Coventry and Warwickshire are not immune to the challenges in the global economy. The service sector is still seeing strong growth, but while manufacturing grew strongly between 2012-2014, there has been a weakening of business activity and investment in the last few quarters. There has been a significant fall in exporting activity since the end of 2014, although the balance between those seeing increases versus those seeing a decrease is still positive. Given the fall in exporting seen at a national level, this would suggest the manufacturing sector in Coventry and Warwickshire, while clearly being affected by global conditions and the strength of the pound, is weathering the storm better than average. On a more positive note, the profitability of businesses within the area remains strong and growing, undoubtedly benefitting from the fall in energy and raw material prices.

Source: C&W Quarterly Economic Survey (Q2 2015)