Post-Brexit inflationary pressures starting to impact on consumers

One of the most significant and obvious impacts on the economy of the EU referendum result earlier this year is the strong depreciation in the value of sterling.

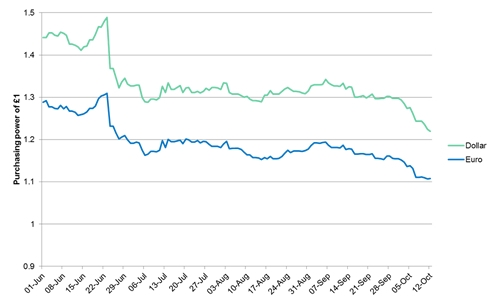

The pound has fallen considerably against a range of currencies, and particularly the US Dollar (down around 18% from its peak before the referendum) and the Euro (down by about 15%), as shown in the graph below.

While a less valuable pound should be good news for exporters (whose goods now appear significantly cheaper in overseas markets) and for overseas tourists visiting the UK, it also had the consequence of increasing the cost of imported goods and services.

While these price increases may not be immediate (as wholesalers often hedge the prices of goods for a fixed period to mitigate volatility in the markets), there are signs that inflationary pressures are starting to work their way through the system to consumers.

First there was the very public disagreement between Tesco and Unilever over the price of Marmite and other goods (which has consequently led to an average price-rise of a basket of Unilever goods in the UK’s four biggest supermarkets rising by an average of 5.7%); then reports that the makers of Typhoo Tea and Walkers crisps were requesting a 12% price increase; and finally (and possibly the last straw!) images that Toblerone has remodelled its bar to reduce its size to offset the cost increases.

Within a globalised economy, many UK manufacturers also import a lot of their components. As a result, while the relative cost of their final goods may be cheaper overseas due to the weak pound, this may not necessarily lead to an increase in output and profits as input costs are offsetting these benefits.

The latest Purchasing Managers Index survey for manufacturing highlighted the sharpest rise in purchasing costs for the sector in the near-25 year history of the survey. The service sector is being similarly affected, with the sister PMI survey showing the biggest one-month jump in costs for 20 years in October.

In its most recent Quarterly Inflation Report, the Bank of England forecast that inflation would rise from 1.3% this year to 2.7% in 2017 and 2018, and would remain above the Bank’s target of 2% until 2020. These inflationary pressures are expected to impact on real disposable incomes of households over the coming year, reducing spend and constraining the growth of the economy in 2017 and 2018.

The Bank of England has reduced its forecast for growth in these years, along with other commentators such as the CBI and the National Institute of Economic & Social Research. There has even been some rather pessimistic talk of the UK entering a period of stagflation, which occurs when there is very low or zero economic growth coupled with high inflation and creates an equilibrium from which it is difficult to break out (as evidenced by Japan’s so-called “lost decades” of the 1990’s and 2000’s).

While this scenario is extremely unlikely, inflation is a concept and phenomenon that is back in the headlines after a few relatively quiet years, and a further issue that policy-makers will need to contend with in the future.

Given that the pressure on prices is largely external to the UK, import substitution and “buying British/buying local” is certainly an area of opportunity going forward – both for consumers and for businesses.

Small Business Saturday is just one example of positive action that can be taken on this agenda, and something that Warwickshire County Council is again helping to support and promote. For further information, go to: www.warwickshire.gov.uk/smallbusiness-saturday.