The Warwickshire Outlook

Brexit: What does it mean for Warwickshire’s economy?

In this edition of the Economics Blog, it is hard to look beyond the issue dominating the news and the economy at the moment. The referendum vote in favour of the UK leaving the European Union instantly created huge uncertainty not just within the UK economy but across the globe.

Financial markets and businesses hate uncertainty above all else, and this is creating significant instability within the economy. Markets are uncertain because there are no clear details of how a Brexit UK economy would operate in the future and what form of trade deals and arrangements it would be operating to. Moreover, global markets are equally, if not more, concerned with the impact that this change will have on the EU (in terms of contagion effects within other member states reconsidering their relationship with the EU) and on the Eurozone economy (through reduced trade with Britain and impacts on the Euro).

What does this uncertainty mean for the economy? The consensus is that it will generate a significant short-term negative shock to the UK economy and a knock-on impact to the growth potential of both the EU and global economy over the next 12-18 months.

The UK economy is regarded as being substantially weaker than it was before the vote, which has led to a significant reduction in the value of sterling (at the time of writing, the pound was at its lowest rate against the US Dollar for 31 years and was down around 10% on all major currencies) while ratings agencies such as Standard & Poor and Fitch (who assess the riskiness of various investments) have downgraded the UK’s credit rating to AA, with a negative outlook (which means be prepared for further downgrades).

Most economists are forecasting the UK to fall into recession towards the end of 2016 and there is increasing concern over the impact on the property market around the impact of a recession (ability for borrowers to repay mortgages) and investment within the property market (both Standard Life and Aviva have recently suspended trade in their UK property funds for fear of a rush of investors seeking to redeem their investments due to a potential collapse in the property market).

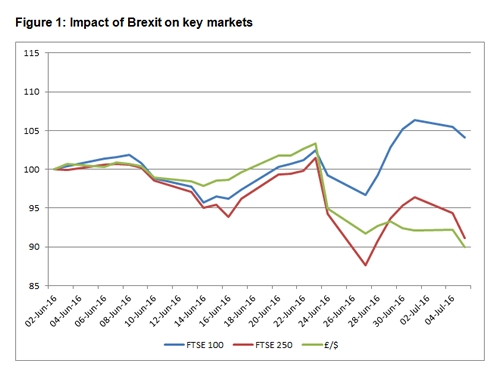

While there appears to be a different story with respect to the FTSE 100 Index (which has bounced back strongly since the vote and is trading at its highest point for almost a year), the Governor of the Bank of England has suggested that people look through this to the FTSE250 (which are comprised of smaller, more UK focused companies rather than the big multi-nationals) for a better view on current market picture. This index has fallen significantly since the referendum and is currently trading almost 9% lower than before. Figure 1 below highlights the recent changes in the FTSE 100, FTSE 250 and £/$ exchange rate.

In practice, what these impacts mean at a national level are (briefly):

- A weak pound, which will help with exporting as our goods will be relatively cheaper in overseas markets but will also create inflationary pressures as the goods we import become more expensive.

- A cut in interest-rates to act as a stimulus against uncertainty and nervousness by investors. As the current Bank of England base-rate is already incredibly low at 0.5%, this could mean a zero or even negative rate of interest in the short-term.

- A further monetary stimulus package by the Bank of England (i.e. quantitative easing) to inject more money into the system for lending and investment. The Bank of England immediately after the result signalled that it had earmarked £250bn to pump into the system if required to ease concerns of the markets and has just recently relaxed rules on capital buffers to enable an additional £150bn of lending to be freed up.

- A tightening of the risk profile for lending, which is likely to have a negative impact on the ability for businesses (particularly new and small/micro enterprises) to access finance.

- An increasing structural deficit with respect to public finances.

So what does all this mean for Warwickshire and what policy responses are required to support the local economy?

Firstly, the weakness in the pound presents opportunities for exporting businesses which should be exploited, if possible, in both the short-to-medium term and longer-term. Businesses should be pro-actively exploring exporting opportunities beyond the EU as a way of diversifying markets, reducing risk and identifying new areas of trade. The Coventry & Warwickshire Chamber of Commerce have an International Trade Team, funded via UK Trade & Investment, which can provide help and support to businesses trade internationally and can be contacted on 024 7665 4321.

Secondly, there is even stronger need to provide a programme of business support across Warwickshire, helping individuals to develop and start their own businesses, and supporting existing businesses to identify and exploit growth opportunities. Warwickshire County Council, working with partners across the Coventry & Warwickshire area, have invested in a new comprehensive programme of support which is coming on stream now and over the next couple of months. Interested individuals or businesses should either contact the Coventry & Warwickshire Growth Hub for initial advice as to the best source of support within the programme, or can contact the County Council’s Economy & Skills team direct.

Thirdly, action should be taken to improve the supply of finance to companies with growth ambitions. The County Council is, therefore, investing a further £200k of its Warwickshire Growth Fund into a new £800k loan fund which will provide significant additional finance for businesses. Delivery partner, Coventry and Warwickshire Reinvestment Trust, are also investing £600k. Further details can be found at www.cwrt.uk.com. The County Council will also launch a new round of its small business grants programme later in the year.

Fourthly, the importance of developing the talent pool locally to meet the needs of our business community will become increasing important in a post Brexit world. A highly skilled, confident and creative workforce will be critical in helping the local business base address the challenges ahead and compete in the global economy. A continued investment in skills, and a focus on aligning education and training to business needs, is therefore essential.

Finally, there is a need to ensure continued investment in the local economy to support and bolster business and consumer confidence. The County Council will work with our key partners to engage pro-actively with the UK Government as discussions surrounding Brexit continue, seeking to ensure that the needs and issues of our local economy and business base are recognised and the future growth of the area is supported. This includes seeking assurances from Government about European and other funding allocated to Warwickshire and the sub-region.

It is worth remembering that at this point in time, nothing has actually changed. The negative shocks that are currently occurring in the economy are based on fear and uncertainty. John Meynard Keynes wrote in the 1930s about the concept of “animal spirits” and its importance to the performance of economies. It describes the role that instincts and emotions play in spending and investment decisions by businesses and consumers. When there is uncertainty about the future and fear of what may happen, people are less inclined to spend, reducing aggregate demand and effectively leading to the negative outcome they originally feared! There is therefore a clear need within the discussions on Brexit to seek to calm nerves, improve market confidence and seek to create greater certainty within the market place.

Business who have questions or concerns arising from the Brexit decision can contact the Chamber of Commerce’s “Brexit Helpline” for impartial business advice. Telephone: 02476 654321.