Tight labour market could impact on wages

The latest inflation figures have just been released by the Office for Nation Statistics (ONS) and the rate of inflation has fallen by more than many forecasters anticipated.

The Consumer Price Index has fallen to 2.7% in February, down from 3% in January. This is largely due to the impact of the devaluation of sterling, following the Brexit referendum result, starting to work through the system (inflation looks at the change in prices compared to the same time 12 months earlier; and it is now 14 months since sterling reached its lowest point against the dollar). The largest downward contributions to the change in inflation rate came from transport and food prices which rose by less than a year ago.

These latest inflation figures are now below the Bank of England’s forecasts, which could potentially undermine the case for a rise in interest rates that has been quite heavily hinted by various members of the Monetary Policy Committee (an interest rate increase is a common monetary policy tool to reduce inflation as, all other things being equal, it encourages people to spend less and save more, thus reducing pressure on prices).

However, the Bank of England has always maintained that the Brexit referendum inflation impact was only temporary - and they have been “looking through” this data to focus on wider underlying trends.

The real concern has been around the increasingly tight labour market (high levels of employment, historically low unemployment rates), and the impact this might have on wages.

The Bank’s concern is that a shortage of labour will force businesses to increase wages which will then push up inflation both by increasing the input costs for businesses, that will necessitate higher prices, and increasing spending power of consumers chasing goods and services which could drive up prices.

ONS have also just released their latest data on wages and it shows average basic pay across Britain has increased by 2.6% on the year before, for the three months to January (up from the previous +2.5% in the three months to December 2017).

Including bonuses, earnings are estimated to have risen by 2.8% (up from 2.5% last month) - the biggest increase since September 2015. For those lucky enough to receive a bonus, wage growth is now very slightly above inflation and therefore “real wages” (wages adjusted for inflation) have started to climb again.

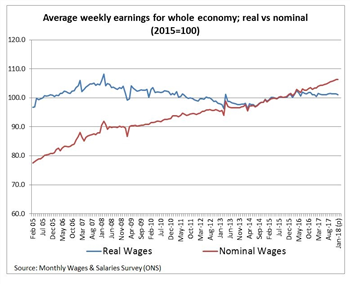

Is this enough to convince the Bank of England that their fears may be being realised and therefore a small interest-rate rise will help keep inflationary pressures in check? Personally, I think it is unlikely at the moment. Real wages are actually still below what they were before economic crash, which is now ten years ago (see the chart below).

Given the pressures on household spending currently, it is likely that there is sufficient capacity within the economic system to absorb relatively small real-wage increases without pushing inflation up. Moreover, there are no real signs that wages are starting to accelerate – analysis of advertised average wages does not see any increases coming through at the moment. Indeed, compared to a year ago, average advertised wages in England have barely changed, and in Warwickshire there has been a reduction (down from £34,300 in February 2017 to £32,700 in February 2018).

Source: Monthly Wages & Salaries Survey (ONS)

Despite all this, the probability of an interest rate rise is still relatively high as the Bank of England have been persistently preparing the ground for a number of small interest-rate rises. The financial markets have been pricing in these future changes, so to now not raise interest rates could potentially have more of negative impact that doing so despite a fragile economic backdrop.

Ultimately, the Bank of England needs some ammunition against an economic shock or risk of recession and cutting interest rates is one of the few weapons they possess. Interest rates will need to rise soon, if only to enable them to be cut again if the economic picture starts deteriorating.