Muted spending paints mixed picture for retailers over Christmas

By Warwickshire County Council head of Economy & Skills Dave Ayton-Hill

In the last Warwickshire Means Business Economic Outlook, I talked about the importance of the Christmas trading period for the retail sector.

The strength and volume of consumer spending during the Christmas period is always a good barometer for the underlying health and confidence within the economy - so how did Warwickshire's retail sector fare over Christmas 2017?

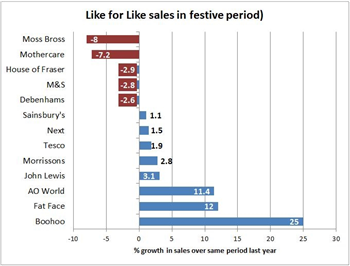

Overall, the picture seems mixed. A number of listed retail companies have published their festive trading figures and there are clearly some winners who have seen increases in “like for like” growth (i.e. comparing sales from last year based on the same retail footprint, so therefore ignoring any new stores that may have opened that would distort figures around “growth” in sales). These include some supermarkets (Tesco, Sainsbury, Waitrose), stores with good on-line presence (Next) and newer, purely on-line companies such as Boohoo and AO which are doing extremely well.

However, others have struggled, including retail giants such as Marks & Spencer, House of Fraser and Debenhams. These figures seem to reinforce the importance of focused consumer targeting, competitive pricing and strong on-line platforms to the retail sector.

The data emerging also suggests that, while some businesses may have benefited from growth in sales, profit margins are being squeezed as a result of heavy discounting to attract consumers through the doors. For instance, while John Lewis has seen growth in sales, they have warned shareholders that profits are likely to be down, largely as a result of their price-matching pledge.

The British Retail Consortium has released figures on high street spending for December and their data suggests that spending increased only modestly by 0.6%, much of which was down to higher prices due to inflation. Moreover, growth was focused in food sales (+2.6%), while overall non-food sales fell by 2.2%. VISA (the card payments firm which accounts for a third of all UK consumer spending) also reported an overall fall in consumer spending, with a fall of 1% compared to spend in the previous December. This is the first fall in Christmas spending they have recorded in five years.

So it would seem that while some retailers have been successful during the festive period, the overall picture is that of muted consumer spending and determined “bargain hunting” by households on the more discretionary items of spend. This has led to a drop in overall spending and a reduction in profit margins for business and suggests a subdued economic situation, as households watch their spending in light of tightening budgets and static (or falling) real wages.

Global economic growth accelerates

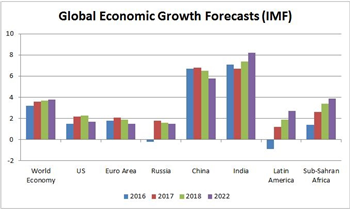

Recent data published by the International Monetary Fund paints a positive picture about accelerating economic growth across the world and, in particular, key markets for the UK (including the Euro-zone, the US, China and India).

The graph below provides the latest predictions and highlights the significant exporting opportunities that this global growth generates for UK companies. The buoyant global economy has been a key part of the strength of the UK’s manufacturing sector over the past 12-18 months, helped significantly by the devaluation of sterling since the referendum result.

The latest surveys from the manufacturer’s organisation EEF, national PMIs for the manufacturing sector and local results from the Warwickshire County Council/C&W Chamber of Commerce Quarterly Economic Survey all point to high confidence within the manufacturing sector about future orders and future sales, particularly in overseas markets.

Indeed, the fourth quarter figures for our local Quarterly Economic Survey show record high levels of confidence and growth within the manufacturing sector. The strong growth across all parts of the global economy is absolutely key to this confidence.