Economics Blog November 2015

Positive outlook by firms in Coventry & Warwickshire

The 3rd Quarter statistics from the Coventry & Warwickshire’s Quarterly Economic Survey have been produced and present a picture of cautious optimism.

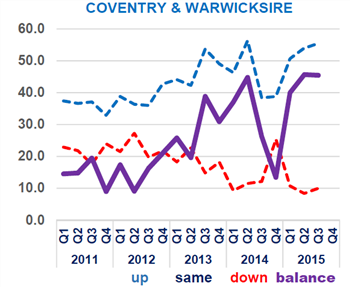

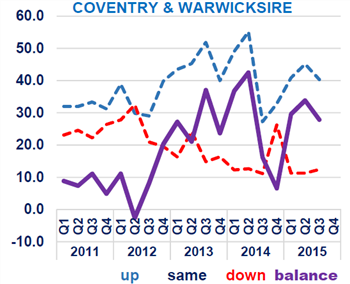

In the last quarter, the significant proportion of businesses have seen their sales and order books increase, with a healthy positive balance between those seeing increases than those seeing decreases – see the graphs below. However, exporting companies have seen the demand for goods and services from overseas customers reduce substantially since the end of 2014, highlighting the local impact of the global economic slowdown.

| Sales in the last 3 months |

Orders in the last 3 months |

|

|

Looking to the future, around two thirds of the companies surveyed in Coventry & Warwickshire expect to see their turnovers improve while a third expect to invest more in capital equipment in their business and around a third also forecast that their workforce will increase in size.

The Chamber of Commerce Quarterly Economic Survey presents a key opportunity for local businesses to feed in their views, issues and concerns to inform policy and investment decisions on a local and national level. Please play your part by completing the current survey to make your voice heard and help support the interests of local businesses.

Pay rises to stay low despite continuing economic recovery

The latest Labour Market Outlook by the CIPD (the professional body for HR and people development) shows that near-term employment prospects remain well above the survey’s historic average. The net employment balance for the fourth quarter of 2015 – which measures the difference between the proportion of employers who expect to increase staff levels and those who expect to decrease staff levels – is +28, slightly below the estimate of +29 in the previous quarter.

Confidence continues to be greatest in the private sector (+41) with private services leading the way (+42). However, employers still see a fairly loose labour market with plenty of supply and the report reveals that UK employers continue to be able to recruit the workers they need without significantly hiking wages. Median basic pay rises of just 2% are predicted by employers in the 12 months to September 2016.

This message, however, does contrast with an increasing concern from employers around hard-to-fill vacancies and difficulties with recruitment. The CIPD survey found that some 15% of vacancies are reported as being hard to fill. However, some 30% of businesses in the Chamber of Commerce Quarterly Economic Survey stated that they had problems recruiting suitable staff in the last quarter and nearly 50% of local manufacturing companies said that they faced skills shortages.

A natural response to a tighter labour market and skills shortages would be an upward pressure on wages, but both the CIPD and the Chamber’s survey suggest that employers do not see this happening over the next year. Further investigation is therefore required to better understand these apparently conflicting messages.

Latest Quarterly Inflation Report – interest rates on hold for the time being

The Bank of England has just published its latest Quarterly Inflation Report which shows that falling global energy and commodity prices, along with weakening growth rates, outweigh the inflationary pressures in the UK from the recovery. In effect, this means that inflation in the UK is lower than was forecast last year and will therefore prevent any interest rate rises for the foreseeable future. Indeed, the financial markets are currently pricing in a rate-rise to occur around the middle of 2016.