Coventry & Warwickshire industrial market reaches new highs

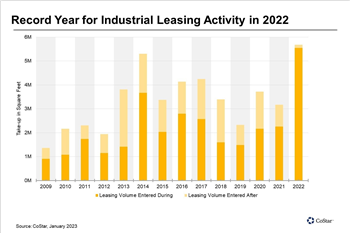

The leasing of Industrial space in the Coventry Market enjoyed a record year in 2022 due to a number of landmark deal activity for units greater than 100,000 square feet, according to commercial property platform CoStar.

The Coventry market includes the city area as well as the five district and boroughs of Warwickshire: North Warwickshire, Nuneaton & Bedworth, Rugby, Warwick and Stratford-on-Avon. Take up rates exceeded 5m sqft and Coventry & Warwickshire posted its best year for the data set 2009-22, even out-pacing 2014, the last time take-up exceeded the 5m mark. In 2021 the same figure, though still strong, was less than 3.5m sqft.

According to the data presented by CoStar's Lisa Dean, vacancies at 3.1% have increased slightly since the start of 2023, but they remain below their long-run average of 4.9%.

The strong performance partly reflected key larger sites coming online that had been allocated in local plans, including SEGRO plc Coventry Gateway, Tritax Symmetry Rugby and Baytree Logistics Properties Faultlands Farm. These lettings to DHL, Rhenus Logistics and Maersk all represented FDI (foreign direct investment) from Germany and Denmark.

Sustainability was a focus of the Baytree developed Rhenus Campus on the edge of Nuneaton, where Rhenus Warehousing preleased a combined total of 981,000sqft in September 2022 at two units. This is across the road from where Hello Fresh took on the Goodman Nuneaton 230 newbuild unit to house its Beehive operation in 2020.

DHL expanded its presence significantly in the Coventry market last year. It took 480,000sqft at Coventry Cross Business Park in October. The company also took an additional 300,000 square feet at Ryton 302. Work has also started on its new £230 million hub at Segro Park Coventry, which will double its processing capacity.

Maersk took the Panattoni speculatively developed space Tamworth 345 on the CORE 42 development at Dordon, as Maersk enters the 3PL market. The 345,000sqft spec built unit has excellent access to J10 of the M42.

The rise in this leasing activity is being led by e-commerce and 3PL demand, rather than manufacturing. 3PL or third-party logistics is where a provider offers outsourced logistics services, and promises to improve efficiency and reduce costs for retailers and businesses.

Coventry and the north of the county sit in the so-called ‘logistics golden triangle’ and this strategic location gives 3PLs access to 90% of UK population within four hours, providing a strong rationale for locating here. This area accounted for a record 18% share of UK industrial leasing activity in 2022, up markedly on the 10-year average of 13%, according to CoStar. According to James Breeze of CBRE, quoted in The Economist reckons the transport of goods accounts for about half a typical company’s supply-chain expenses. Warehouse rental is a mere 6% so a prime location like the Coventry market will help reduce trucking costs.

The success of the Coventry market over last year was also recently underlined by agents Avison Young, who published data on their national industrial team transactions. The agency achieved lettings of over 9m sqft, with over half of those deals being made in the Coventry & Warwickshire and West Midlands market.

Invest Coventry & Warwickshire, the inward investment and place promotion agency, recently estimated a pipeline of 20m sqft of industrial space recently delivered or in development, including the space in the 2022 data included in the CoStar calculations.

While this development space is positive for the region, the majority of this space is for larger units in excess of 100,000sqft, and there remains a lack of new development of this smaller space. The Spa Park scheme at Leamington Spa from Blackrock/Stoford, which has four units remaining totalling 151,000sqft, the new 35,000sqft AC Lloyd Space Park development with 61 units of 200-500sqft, the Wigley Group development of nine units between 1500 and 5000sqft at Stonebridge Industrial Estate, and the Warwickshire Property Development Group (WPDG) Southam Park development with nine units of 42,000sqft in total, are among some local sites that will address some of this need for smaller spaces. But according to the commercial agent community, and referenced in the recent Bromwich Hardy Barometer report, there is still a lack of supply in some Coventry & Warwickshire locations.

Invest Coventry & Warwickshire tracks the local commercial property and can help businesses looking for office, industrial, retail and warehouse space in the local market. Property searches can also be carried out using our property search portal http://commercialproperty.coventry-warwickshire.co.uk/